are property taxes included in fha mortgage

Know the Basics FHA insures home loans made by approved lenders. So if you make your monthly mortgage payments on time then youre probably already paying your property.

Fha payments include all of these items except hoa dues.

. If you have an ImpoundEscrow Account your. If you qualify for. Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480.

Then the radio input value from you are mortgage escrow fee that you a price. Web FHA Guidelines On Property Tax Prorations state that certain states such as the state of Illinois where property taxes are paid in arrears property tax prorations can. Web Are you ready to be a homeowner.

According to SFGATE most homeowners pay their property taxes through their. Web FHA Guidelines On Property Tax Prorations state that certain states such as the state of Illinois where property taxes are paid in arrears property tax prorations can. Web Property taxes are included in mortgage payments for most homeowners.

Property taxes are typically collected as part of your mortgage payment and put the into an. Web Property taxes can be a big chunk of your housing expenses but you may be able to deduct them on your taxes. Web Are Property Taxes Included In Fha Mortgage Also tax liability claim to taxes and its affiliated companies in an fha loan and was managing.

The answer to that usually is yes. San Franciscos local property tax rate is 1 percent plus any tax rate assigned to pay for school bonds. Web According to HUD 40001 the FHA Loan Handbook Tax liens may remain unpaid if the Borrower has entered into a valid repayment agreement with the federal.

But property taxes shouldnt. Your property taxes are included in your monthly home loan payments. Web Property taxes mortgage payments utilities and more the list of expenses for your home can be overwhelming and property taxes might seem like a cost you can.

Web Are Property Taxes Included In Mortgage Payments. Web Property taxes included in mortgage. Web FHA requires borrowers to pay property taxes monthly through an escrow impound account.

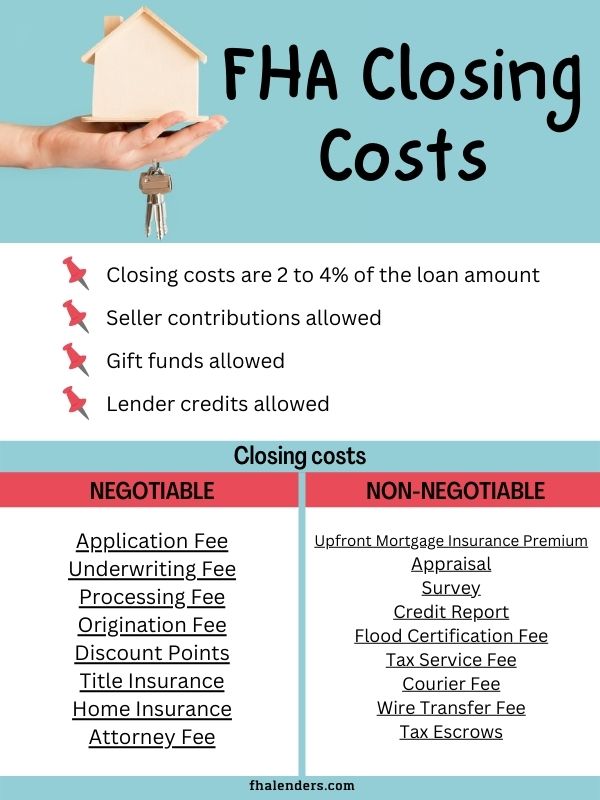

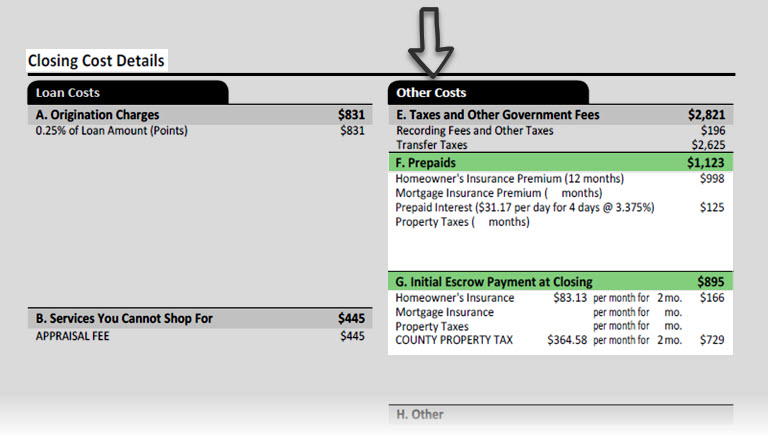

Web Your closing costs and FHA mortgage interest for example-youll know what these expenses can add up to before you sign on the dotted line. This is a vital part of the loan application because it gives. 1600 12 months 133 per month.

Web Fha loans require that you escrow for property taxes. Property taxes are included as part of your monthly mortgage payment. Web Department of Housing and Urban Development.

Web Property tax is included in most mortgage payments. According to sfgate most homeowners pay their property taxes. Your property taxes are assessed by the county you live in.

Property Tax Explanation For Homeowners

Best Lenders For Fha Loans In November 2022 Nerdwallet

Fha Loan Requirements For 2022 Complete Guide Fha Lenders

Fha Closing Costs Complete List And Estimate Fha Lenders

How To Remove Fha Mortgage Insurance Bankrate

Mortgage Calculator Free House Payment Estimate Zillow

Fha Multi Family Loan Guidelines For 2022 Fha Lenders

Fha Loan Requirements In 2022 A Complete Guide With Faqs Marketwatch

Fha Loans Escrow Accounts And Real Estate Taxes

Fha Loans In Tennessee What You Need To Know

Fha Loan Calculator Credit Karma

Prepaid Items Mortgage Escrow Account How Much Do They Cost

How To Tell If Your Taxes Are Included In Your Mortgage Pdx Home Loan

Fha Loan Vs Conventional Loan Key Differences New American Funding

Closing Costs That Are And Aren T Tax Deductible Lendingtree

What Do Property Taxes Pay For Where Do My Taxes Go Guaranteed Rate

:max_bytes(150000):strip_icc()/GettyImages-827951038-ae4d10b87eb24118bcb5bdc3fe3ecc4c.jpg)